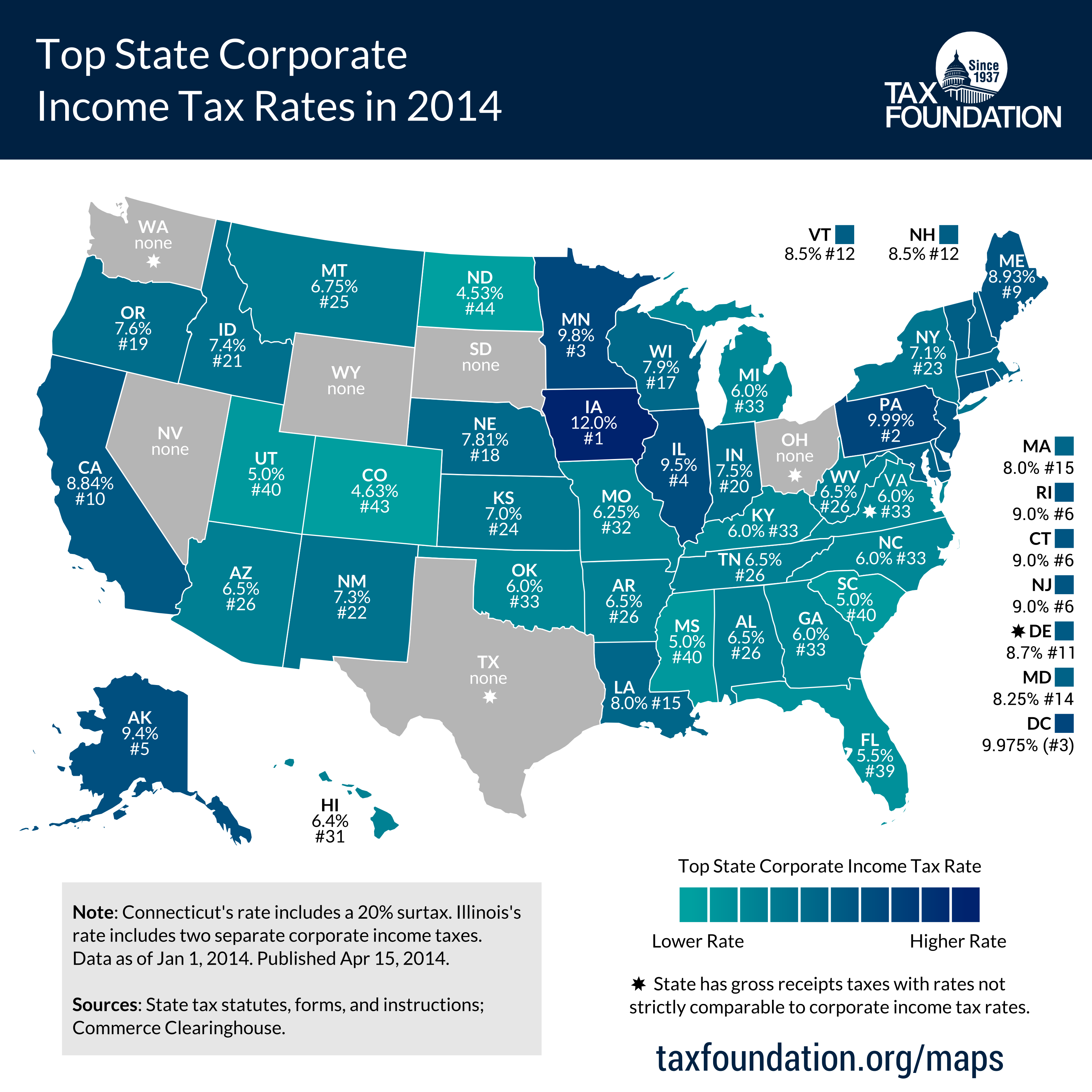

b&o tax states

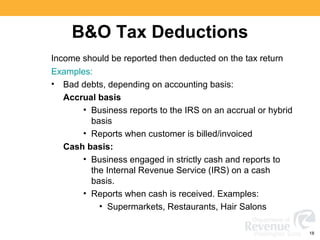

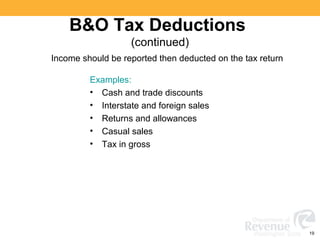

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. The BO offers very few deductions and those allowable are often within narrowly defined industry sectors.

Washington State Sales Use And B O Tax Workshop

It is measured on the value of products gross proceeds of sale or gross income of the business.

. Sales and excise taxes. PO BOX 896 North Bend WA 98045. Washington has a state sales tax rate of 65 which is collected on all retail sales across the state.

Businesses receive a classification with a corresponding tax rate. The current tax rates are 039 per square foot per quarter for business floor space and 013 per square foot per quarter for other. Most classifications come with a tax rate below 1 percent which is low.

The BO tax rates vary depending on business classification. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky.

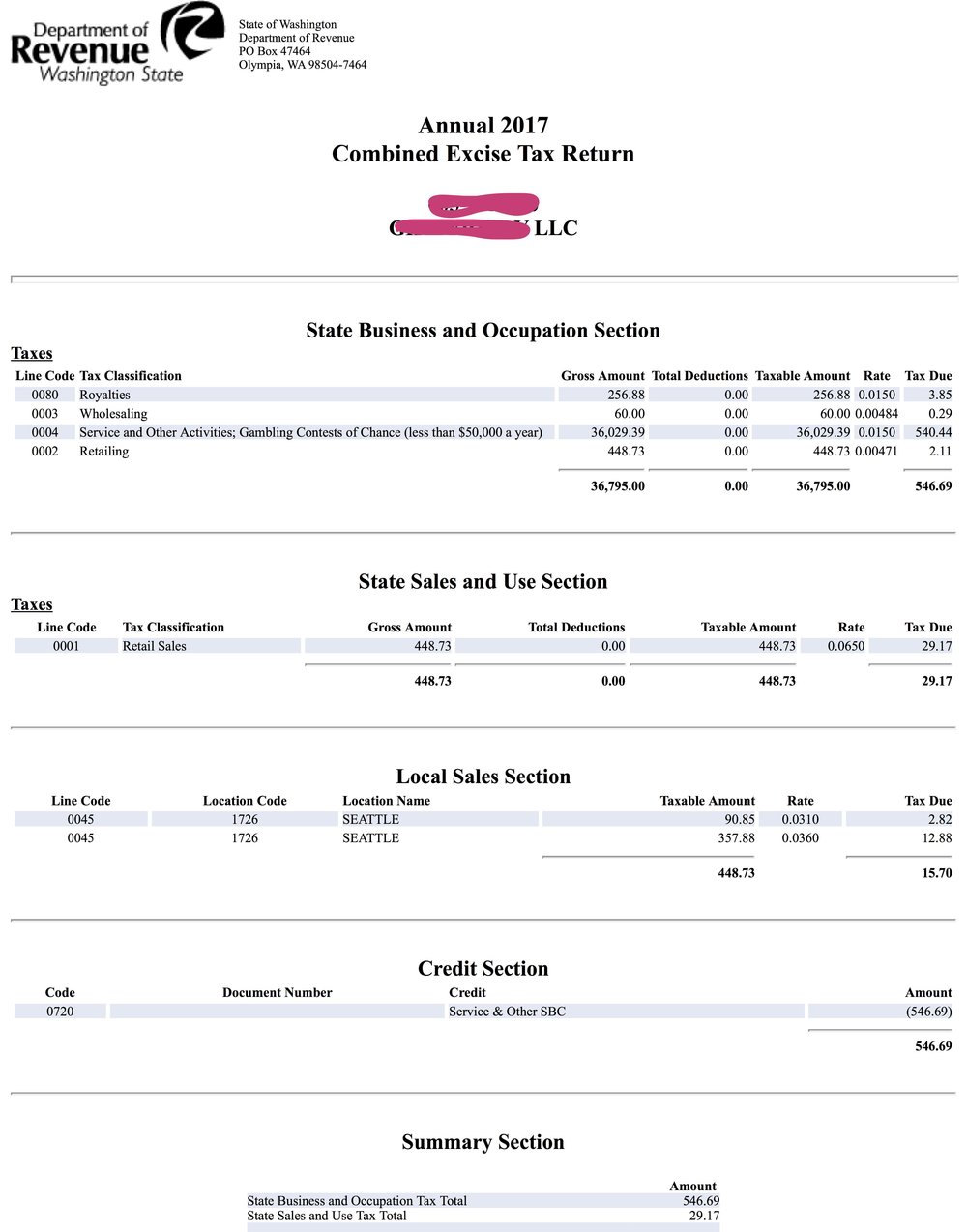

Business and Occupation Tax. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. But service businesses pay a 15 rate.

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Constitution because it discriminates against out-of-state financial institutions.

Complete the form attach your payment and mail to the City of North Bend. And thats an advantage that is often ignored. However you may be entitled to the Multiple Activities Tax Credit MATC.

You must file a Business Occupation Tax Report when the total of your quarterly gross. The State of Washington unlike many other states does not have an income tax. The square footage BO tax is based on rentable square feet.

Both Washington and Tacomas BO tax are calculated on the gross income from activities. Washington unlike many other states does not have an income tax. Business and Occupation Tax.

The Washington Department of Revenue Department recently adopted emergency rule amendments to Washington Administrative Code WAC 458-20-19404 Emergency Rule 194041which became effective January 1 2016 and address how financial institutions must apportion gross income for Washington business and occupation BO tax. The state BO tax is a gross receipts tax. Heres what the BO tax looks like for your business.

The square footage BO tax applies to businesses that maintain a business location within Seattle and conduct out-of-city business activities. Both Washington and Tacomas BO tax are calculated on the gross income from activities. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing.

Commonly the percentage runs about 5 or half a percent. As an incorporated city one way the City of Bainbridge Island raises revenue is through its Business Occupation BO Tax levied on businesses engaging in business in the City. BO also does not consider income or loss offers no deduction for cost of.

It is measured on the value of products gross proceeds of sales or gross income of the business. Have a local BO tax. The relationship between the state BO tax and the local BO taxes is similar at least in concept to the sales tax.

The Washington State Supreme Court today September 30 2021 upheld the constitutionality of the states business and occupation BO tax surcharge imposed on certain financial institutions. Washingtons BO tax is calculated on the gross income from activities. Washington does not have a corporate income tax but it does levy a gross receipts tax known as the Business Occupation BO Tax on companies that engage in business in the state.

The first 1000000 in taxable gross receipts are taxed at 150 minimum tax due and any gross receipts above that are taxed at 026. Kenmores BO tax applies to heavy manufacturing only. Business and Occupation BO Tax Washington State and City of Bellingham Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level.

Washington unlike many other states does not have an income tax. However your business may qualify for certain exemptions deductions or credits. The state BO tax is a gross receipts tax.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Alaska offers the lowest total tax burden of any state costing taxpayers an average of 516 of their income. Mechnically you simply pay a percentage of your gross receipts.

BO also does not consider income or loss offers no deduction for cost of. The Washington state business occupation tax works really simply. To prevent delays in mailing your BO taxes a copy of our BO tax form is located on our website.

May 13 2020 A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US. V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered. The City Business Occupation BO tax is a gross receipts tax.

Heres how the state BO works. 2020 a 20 increase to Washington states business and occupation BO tax goes into effect increasing the tax burden on health care providers including independent. While deductions are not permitted for labor materials or other overhead expenses the State of Washi.

Contact the city directly for specific information or other business licenses or taxes that may apply. And some businesses pay lower rates. Businesses with 150000 or more in revenues attributable to Ohio are responsible for paying Ohio Gross Receipts Tax Commercial Activity Tax either annually or quarterly.

But service businesses pay a 15 rate. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT.

That breaks down to an average of 371 of income going to property taxes the 12th highest in the US 0 in income taxes and 145 of income going to excise taxes. It is a type of gross receipts tax because it is levied on gross income rather than net income. Please make copies as needed.

They then apply that rate to their gross receipts and cut Washington a check.

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Business And Occupation B O Tax Washington State And City Of Bellingham

Wa Dor Combined Excise Tax Return 2020 2022 Fill Out Tax Template Online

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Washington State Sales Use And B O Tax Workshop

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

Don T Miss The Washington State Tax Reconciliation Deadline

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

Washington State Sales Use And B O Tax Workshop

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller